[ad_1]

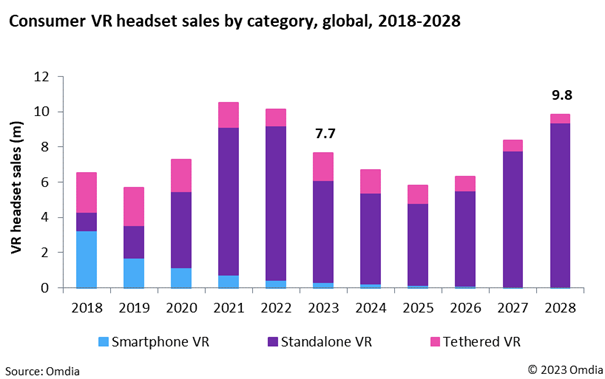

New analysis from Omdia alerts a serious downturn within the client VR market. Headset gross sales suffered a 24% decline in 2023, plummeting to 7.7 million items from 10.1 million in 2022. Additional declines of 13% are anticipated in each 2024 and 2025, marking a difficult interval for the VR business earlier than a projected resurgence from 2026.

The worldwide energetic put in base remained regular at 23.6 million VR headsets in 2023, and solely marginal progress is predicted by 2028, signifying a plateauing market. In response to Omdia’s newest Client VR Headset and Content material Income Forecast, spend on VR content material declined in 2023 to $844 million from the earlier yr’s $934 million. A gradual restoration is predicted beginning in 2024, resulting in content material revenues rising to $2.3 billion by 2028. This might be largely pushed by Apple’s headsets, poised to inject important momentum into the VR market.

A confluence of things led to 2023’s dismal efficiency. Inflationary pressures impacted client spending, compounded by a gradual decline from 2021’s pandemic-induced peak. Furthermore, the underperformance of three pivotal headsets, particularly Meta Quest 3, Sony PlayStation VR2 (PSVR2), and Pico 4 deepened the downturn in 2023.

Meta’s restricted AR content material and the $500 price ticket on Quest 3 discouraged upgrades and failed to draw new adopters. PSVR2 lacked compelling releases, resulting in slower adoption than its predecessor, worsened by Sony’s shift in focus in the direction of increasing PS5 peripherals. In the meantime, ByteDance’s scaled again VR ambitions considerably affected Pico, leading to canceled initiatives and a scarcity of aggressive VR content material, regardless of well-received Pico 4 {hardware}.

The inflow of latest gaming {hardware} decisions in 2024, together with the Swap 2, mid-generation console refreshes, and Steam Deck OLED will seemingly relegate headsets to a decrease precedence for avid gamers, who make up VR’s core consumer base. Amidst tech giants refocusing on AI, the dearth of considerable investments in VR (aside from Meta) is about to end in a droop for the business over the subsequent two years – that’s regardless of Apple Imaginative and prescient Professional launching in 2024, which may have a restricted influence till at the very least 2026.

Omdia and gamedeveloper.com are sibling organizations below Informa tech.

[ad_2]