[ad_1]

Nvidia

Most Ars readers nonetheless most likely know Nvidia greatest for its decades-old GeForce graphics playing cards for gaming PCs, however today Nvidia’s server GPU enterprise makes GeForce appear to be a pastime venture.

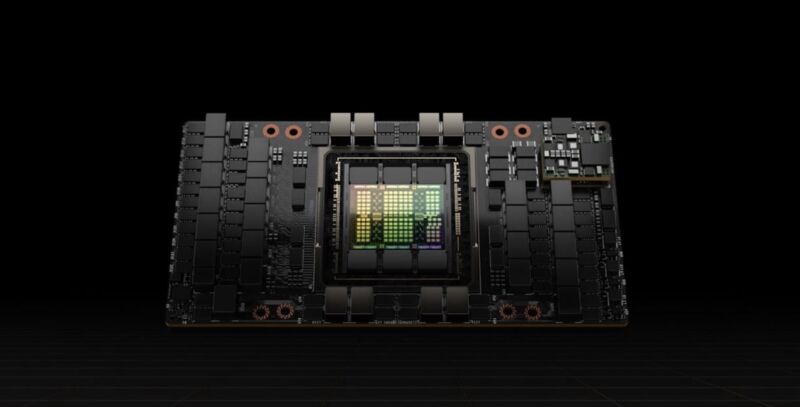

That is the takeaway from Nvidia’s Q3 earnings report, which exhibits Nvidia’s income up 206 p.c from the identical quarter final yr and 34 p.c from an already-very-good Q2. Of the corporate’s $18.12 billion in income, $14.51 billion was generated by its information heart division, which incorporates AI-accelerating chips like the H200 Tensor Core GPU in addition to different cloud and server choices.

And although GeForce income was a a lot smaller $2.86 billion, this was nonetheless a stable restoration from the identical quarter of Nvidia’s fiscal 2023, when GeForce GPUs earned simply $1.51 billion and have been down 51 p.c in comparison with fiscal 2022. Nvidia has launched a number of new mainstream GeForce RTX 40-series GPUs this yr, together with the $299 RTX 4060. And whereas these extra inexpensive GPUs aren’t staggering upgrades from previous-generation playing cards, Steam {Hardware} Survey information exhibits the RTX 4060 and 4060 Ti are being adopted fairly shortly, greater than will be mentioned of competing GPUs like AMD’s RX 7600 or Intel’s Arc collection.

The corporate’s total income numbers weren’t trying practically this good a yr in the past, both—in Q3 of fiscal 2023, the corporate’s income had fallen 17 p.c yr over yr. The quarter earlier than that, the corporate missed its personal projections by $1.4 billion as a consequence of an oversupply of GPUs and a crypto-mining crash that decreased gross sales.

Demand for Nvidia’s AI-accelerating GPUs most likely will not be as risky as demand for cryptomining GPUs was. For starters, there are large corporations with large cash shopping for up nearly each HGX GPU that Nvidia could make, and firms like Microsoft and Amazon proceed to make main AI bulletins and investments at a gentle clip—Nvidia additionally mentioned it is partnering with Dropbox, Foxconn, Lenovo, and a number of different corporations on varied AI initiatives. And, simply as in PC and workstation graphics playing cards, Nvidia’s dominance can beget extra dominance as software program instruments are designed for and optimized for Nvidia’s chips first.

Nonetheless, the crypto-mining instance is instructive. If this bubble bursts, or if competing merchandise from AMD or Intel start making a dent in Nvidia’s gross sales, Nvidia may very well be in for a tough few quarters as these stratospheric income numbers come again to earth. Nvidia has additionally had hassle promoting its AI chips in China, the place US export restrictions on some high-performance chips have brought on Nvidia to switch or cease providing a few of its merchandise to satisfy necessities.

Nvidia’s workstation GPUs and automotive divisions additionally grew yr over yr, although, at $416 million and $261 million, respectively, each divisions contribute rather a lot much less to Nvidia’s backside line than the information heart or GeForce merchandise.

[ad_2]

Leave a Reply