[ad_1]

In occasions of financial disaster, governments typically flip to conventional stimulus methods, comparable to company bailouts or direct monetary support to people. Whereas these strategies can present short-term reduction, they’re typically inefficient and fail to deal with the deeper causes of financial stagnation. To construct a extra resilient and thriving financial system, we want a extra considerate strategy—one which understands the complicated move of cash via the system and emphasizes the essential function of innovation and entrepreneurship in driving long-term development.

That’s the place the Nodal Stimulus Mannequin is available in. This new framework focuses on maximizing the affect of stimulus efforts by concentrating on key “nodes” within the financial system—comparable to people, companies, and organizations—primarily based on three key components: Spend/Save Ratio (SSR), Innovation Coefficient (IC), and Upside Coefficient (UC). By directing sources to those high-potential nodes, the Nodal Stimulus Mannequin goals to make sure that each greenback stimulates significant financial exercise, fosters innovation, and helps sustainable development.

Why Conventional Stimulus Fashions Fall Brief

Earlier than exploring the Nodal Stimulus Mannequin, it’s essential to grasp why conventional stimulus approaches typically fail to ship lasting outcomes.

Bailouts for Giant Firms: Traditionally, massive companies have been the principle beneficiaries of large authorities bailouts throughout financial crises. Whereas these firms might play a job as main employers, they typically hoard money or use it for shareholder payouts fairly than reinvesting it within the financial system. In consequence, the stimulus funds are likely to get caught on the prime, providing minimal trickle-down profit to the broader financial system.

Direct Funds to People: Direct funds, comparable to stimulus checks, do present short-term boosts to client spending. Nevertheless, their affect is fleeting. As soon as the cash is spent, its impact on the financial system fades, with out addressing the structural points that hinder long-term development or innovation.

Inefficient Authorities Spending: Governments typically direct stimulus funds to outdated industries or struggling companies. This strategy wastes sources and redirects focus and funding towards lower-growth sectors, limiting alternatives for job creation and innovation in high-growth areas.

The Core Parts of the Nodal Stimulus Mannequin

The Nodal Stimulus Mannequin provides another strategy by specializing in long-term financial well being. It prioritizes the next three essential coefficients:

Spend/Save Ratio: This metric measures how a lot of the funds obtained by a specific node are spent versus saved. Nodes with a better spending ratio flow into cash extra quickly via the financial system, driving demand for items and companies and producing extra financial exercise.

Innovation Coefficient: This displays the extent of innovation produced per greenback spent. Nodes with a excessive Innovation Coefficient are people who create new concepts, applied sciences, or merchandise—probably remodeling industries, opening up new markets, and fueling sustained financial development.

Upside Coefficient: This coefficient measures the potential for top returns on funding. Nodes with a excessive Upside Coefficient, comparable to startups or industries on the verge of fast enlargement, have the potential to create vital financial worth, unlocking large-scale development alternatives.

The Nodal Stimulus Mannequin, by strategically directing sources to those high-potential nodes, goals to generate a extra impactful and sustainable financial restoration.

How the Nodal Stimulus Mannequin Works

The Nodal Stimulus Mannequin enhances the effectivity of presidency spending by directing stimulus to high-potential nodes—people who rating highest in Spend/Save Ratio (SSR), Innovation Coefficient (IC), and Upside Coefficient (UC). By prioritizing these nodes, the mannequin ensures that stimulus funds are used to create most financial exercise, drive innovation, and promote sustainable long-term development.

Prioritizing Excessive SSR Nodes

A central precept of the Nodal Stimulus Mannequin is that stimulus ought to move towards people and companies with excessive SSRs—those that are almost definitely to spend cash shortly, circulating it via the financial system. Key high-SSR nodes embody:

Low-Revenue Households: People in low-income brackets are likely to have little or no financial savings, forcing them to spend almost all of their revenue on fundamental requirements. Stimulus directed to those households will probably be spent nearly instantly on necessities like meals, housing, and healthcare, offering a direct and instant increase to native economies.

Small Companies: Small companies are a cornerstone of the financial system, accounting for a big share of job creation and client spending. Working on slim margins, small companies reinvest a lot of their income into day-to-day operations, paying workers, and driving native financial exercise, making them extremely efficient at changing stimulus into financial development.

Nonprofits and Social Enterprises: These organizations typically work with restricted sources and spend the vast majority of their funds on companies that immediately profit communities. By directing stimulus towards nonprofits and social enterprises, governments can be sure that cash reaches people and areas in best want, whereas additionally supporting very important companies and neighborhood packages.

By specializing in these high-SSR nodes, the Nodal Stimulus Mannequin ensures that stimulus funds move via the financial system quickly, benefiting those that are almost definitely to spend and producing instant financial exercise.

Case Examine: The Affect of Excessive SSR in Motion

Through the 2008 monetary disaster, many governments targeted on bailing out massive monetary establishments and companies, however the true financial restoration was pushed by client spending on the native stage. Stimulus packages that directed funds to low-income households and small companies helped create a ripple impact, as every greenback spent by these high-SSR nodes flowed via the financial system, supporting native companies and creating jobs.

Fostering Innovation via Excessive IC Nodes

Whereas client spending is essential for short-term financial restoration, long-term development depends on fostering innovation. Excessive-innovation nodes are people who drive the event of latest merchandise, companies, and applied sciences, remodeling industries and creating sustained financial enlargement.

The Nodal Stimulus Mannequin locations a powerful emphasis on investing in industries and companies with excessive Innovation Coefficients (ICs), comparable to:

Expertise Startups: Startups are sometimes on the chopping fringe of innovation, growing disruptive applied sciences and pioneering new enterprise fashions. Their agility and cost-efficiency permit them to generate vital innovation with fewer sources in comparison with bigger companies. Stimulus directed towards expertise startups can speed up breakthroughs and foster the following wave of trade transformations.

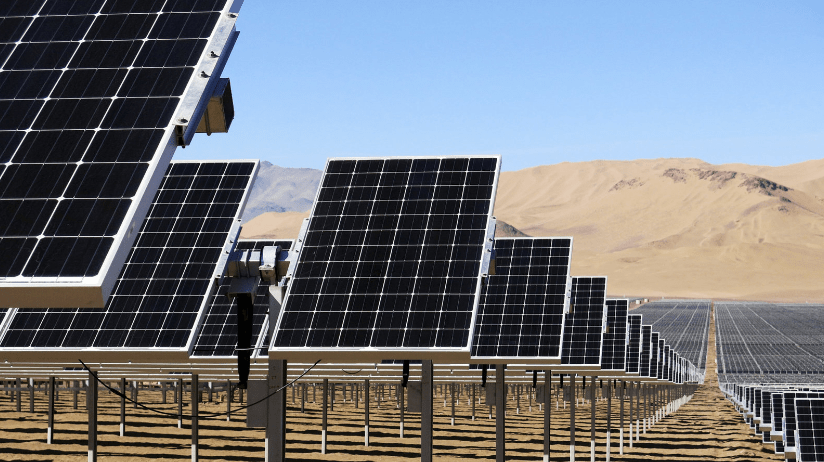

Clear Vitality: The clear vitality sector represents a high-innovation trade with large long-term potential. Investments in renewable vitality applied sciences generate jobs whereas actively contributing to options for the worldwide local weather disaster. This sector is primed for development, with improvements in photo voltaic, wind, and vitality storage resulting in extra sustainable and resilient economies.

Healthcare and Biotechnology: The COVID-19 pandemic highlighted the essential want for innovation in healthcare and biotechnology. Investments in these sectors can result in groundbreaking developments in remedies, vaccines, and medical units, bettering public well being outcomes and creating new markets. Continued innovation on this area will probably be important for addressing future well being challenges and advancing medical expertise.

Case Examine: How Innovation Drove Put up-Battle Financial Progress

After World Battle II, a number of nations, notably the US and Japan, made substantial investments in expertise and infrastructure. These efforts laid the groundwork for the technological revolution of the late twentieth century, spurring thousands and thousands of jobs and reshaping total industries. The Nodal Stimulus Mannequin goals to copy this success by specializing in high-innovation sectors, guaranteeing that in the present day’s stimulus investments generate long-lasting financial development.

By directing sources towards high-IC nodes, the Nodal Stimulus Mannequin fosters an setting the place innovation can thrive, driving each instant financial restoration and future prosperity.

Betting on Excessive Upside: The Energy of the UC

The Nodal Stimulus Mannequin locations vital significance on investing in nodes with excessive Upside Coefficients (UCs)—companies or sectors which have the potential to generate substantial financial returns if profitable. By betting on high-upside ventures, this mannequin goals to unlock exponential development alternatives that may reshape industries and create lasting financial affect.

Startups with Excessive Progress Potential

Startups are inherently dangerous, however people who succeed typically produce large returns. For example, firms like Google, Fb, and Tesla began as small, unsure ventures however grew into international powerhouses that reworked industries and created thousands and thousands of jobs. By strategically investing in startups with excessive upside potential, the Nodal Stimulus Mannequin can catalyze comparable outcomes, supporting companies that would turn out to be tomorrow’s trade leaders.

Disruptive Applied sciences

Investing in applied sciences that problem established norms and create new markets is one other instance of high-upside alternatives. Rising applied sciences comparable to synthetic intelligence, blockchain, and quantum computing supply the potential for exponential returns by revolutionizing industries and creating fully new financial ecosystems. These applied sciences can result in breakthroughs that reshape how we dwell, work, and work together with the world, making them prime candidates for stimulus-driven funding.

Infrastructure Initiatives with Lengthy-Time period Advantages

Investments in infrastructure, comparable to high-speed web, clear vitality, and superior transportation programs, supply each instant job creation and long-term financial advantages. By bettering productiveness, connectivity, and effectivity, these tasks present a basis for sustained financial development. Infrastructure enhancements can increase the competitiveness of total areas, opening up new alternatives for companies and people alike.

Case Examine: Enterprise Capital’s Function in Financial Progress

Enterprise capitalists (VCs) are recognized for taking calculated dangers by investing in high-upside startups, understanding that whereas many will fail, a number of will generate returns that far outweigh the losses. Early buyers in firms like Amazon and Airbnb confronted vital uncertainty, however their bets paid off enormously. Governments can undertake an identical strategy, strategically investing in high-upside ventures with the potential to drive financial development and create jobs. By embracing the rules of the enterprise capital mannequin, the Nodal Stimulus Mannequin encourages governments to give attention to alternatives with transformative potential.

By channeling stimulus funds into high-UC nodes, the Nodal Stimulus Mannequin ensures that the financial system is positioned for vital long-term development, even when some investments contain larger threat. This strategy maximizes the potential for transformative breakthroughs that may unlock new industries and drive large-scale financial returns. high-upside ventures which have the potential to create jobs and drive financial development.

Sensible Implementation of the Nodal Stimulus Mannequin

The Nodal Stimulus Mannequin provides a sensible framework that governments can use to form financial coverage and allocate stimulus funds successfully. Right here’s how it may be carried out to maximise financial affect:

Deal with Small Enterprise and Entrepreneurial Help

Governments ought to prioritize a portion of stimulus funds for entrepreneurs and small companies with excessive development potential. This may take the type of grants, low-interest loans, or direct monetary assist to assist entrepreneurs cowl fundamental dwelling bills whereas they develop their companies. Small companies and startups are key drivers of job creation and innovation, making them essential nodes for exciting financial development.

Put money into Innovation-Pushed Industries

Stimulus funds ought to goal industries recognized for driving innovation, comparable to clear vitality, healthcare, and expertise. By investing in high-Innovation Coefficient (IC) sectors, governments be sure that stimulus {dollars} handle instant financial challenges whereas creating long-term advantages via the event of latest applied sciences and industries that drive sustained financial development.

Create Applications for Low-Revenue Households

Direct monetary assist for low-income households needs to be a central a part of any stimulus plan. These people are likely to have the best Spend/Save Ratios (SSRs), which means they’re almost definitely to spend the cash shortly on necessities. This instant spending circulates stimulus funds via native economies, serving to companies and creating demand for items and companies, which boosts financial exercise.

Help for Nonprofits and Social Enterprises

Nonprofits and social enterprises play a vital function in supporting high-SSR communities, notably throughout financial crises. By offering funding to those organizations, governments can be sure that very important companies attain weak populations whereas additionally stimulating native economies. These organizations assist preserve social stability, which is essential for restoration and long-term development.

Constructing a Resilient, Progressive Financial system

The Nodal Stimulus Mannequin offers a structured strategy for governments to maximise the affect of stimulus by specializing in key financial nodes. By directing sources to entities with excessive SSRs, excessive ICs, and excessive Upside Coefficients (UCs), governments be sure that stimulus efforts present short-term financial reduction whereas constructing a resilient, progressive financial system positioned for long-term development. Via strategic investments in high-potential areas, the Nodal Stimulus Mannequin fosters an financial setting the place innovation can thrive, jobs are created, and communities can flourish.

[ad_2]